income tax return malaysia

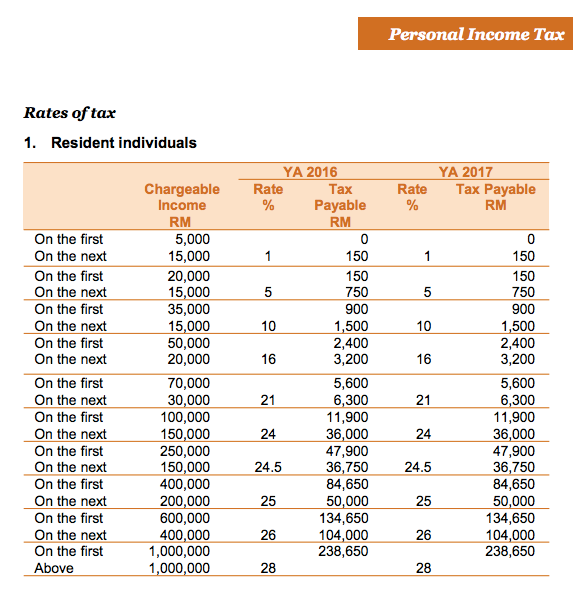

Calculations RM Rate TaxRM 0 - 5000. Individuals with business source.

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

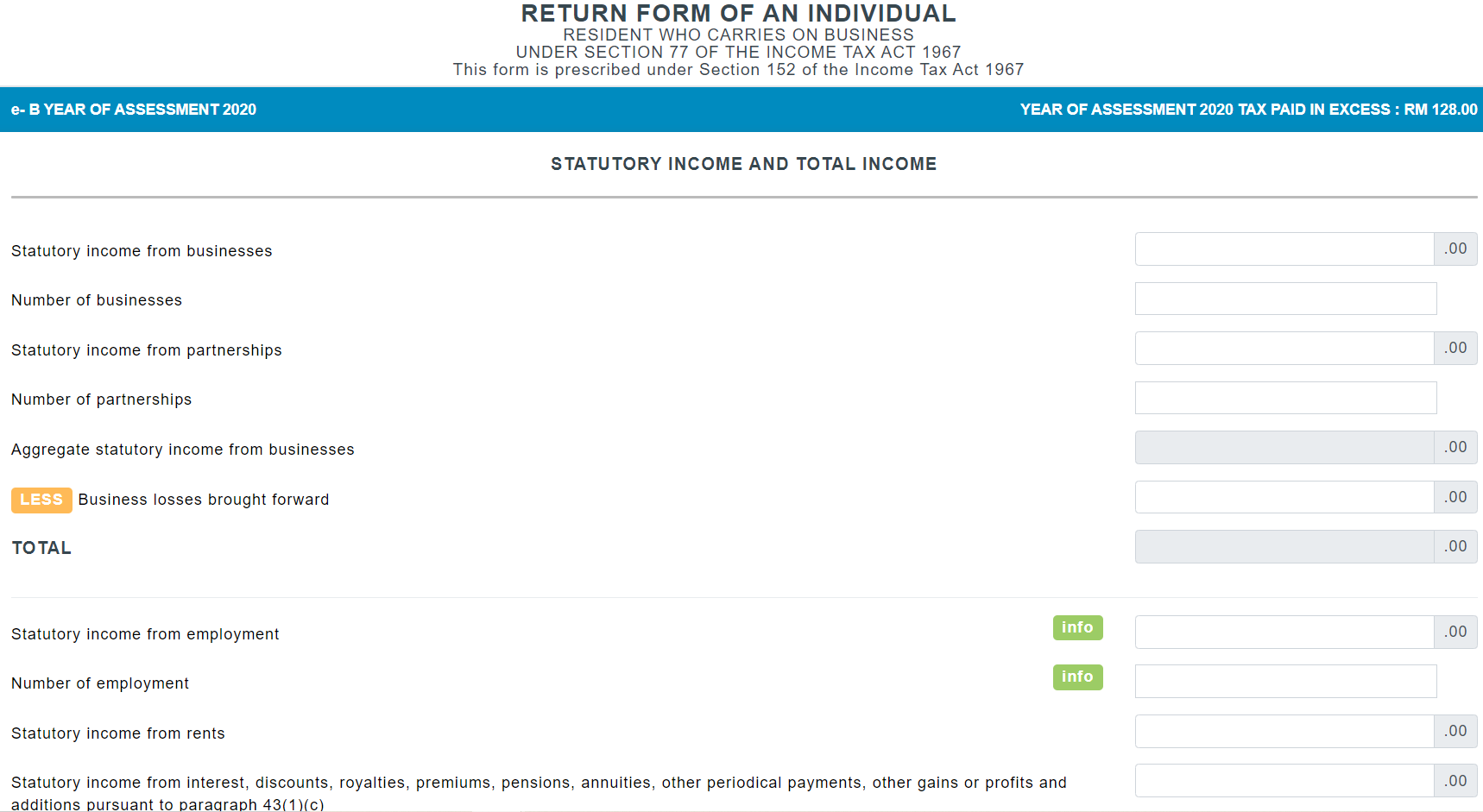

Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for.

. Criteria on Incomplete ITRF. How to apply to file my income tax online for 2022. If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to httpsedaftarhasilgovmy and click.

Its charged at different rates depending on what source of income it relates to. In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. The 2021 filing programme is broadly similar in concept to the position laid out in the original 2020 filing programme see Tax Alert No. Where a company commenced operations.

On or before 30 April every year. First at the top of the page to ensure that you have not already not registered previously. Normally companies will obtain the income tax.

The due date for submission of Income Tax Return. Companies in Malaysia must submit the corporate income tax return within seven months of closing the accounts. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

On the First 5000 Next 15000. In Malaysia income tax is a duty levied on individuals and companies on all income generated. Granted automatically to an individual for.

Individuals without business source. But before that click on the link that says Please Check Your Income Tax No. Kindly click on the following link.

The Complete Guide To Personal Income Tax In Malaysia For 2022 All you need to know for filing your personal income tax in Malaysia by April 30 this year. Companies limited liability partnerships trust bodies and cooperative societies which are. A non-resident individual is taxed at a flat rate of.

First thing first. Malaysia unveiled a leaner budget of RM3723 billion US8006 billion for 2023 on Friday Oct 7 amid an uncertain global environment and an expected slow. Offences Fines and Penalties.

Tax payable must be paid by the last day of the seventh month from. Here are the full details of all the tax reliefs that you can claim for YA 2021. On the First 20000 Next.

He or she has been resident. 12020 prior to the extensions of the. This would enable you to drop down a tax bracket lower.

In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Dialog Minutes For Operational.

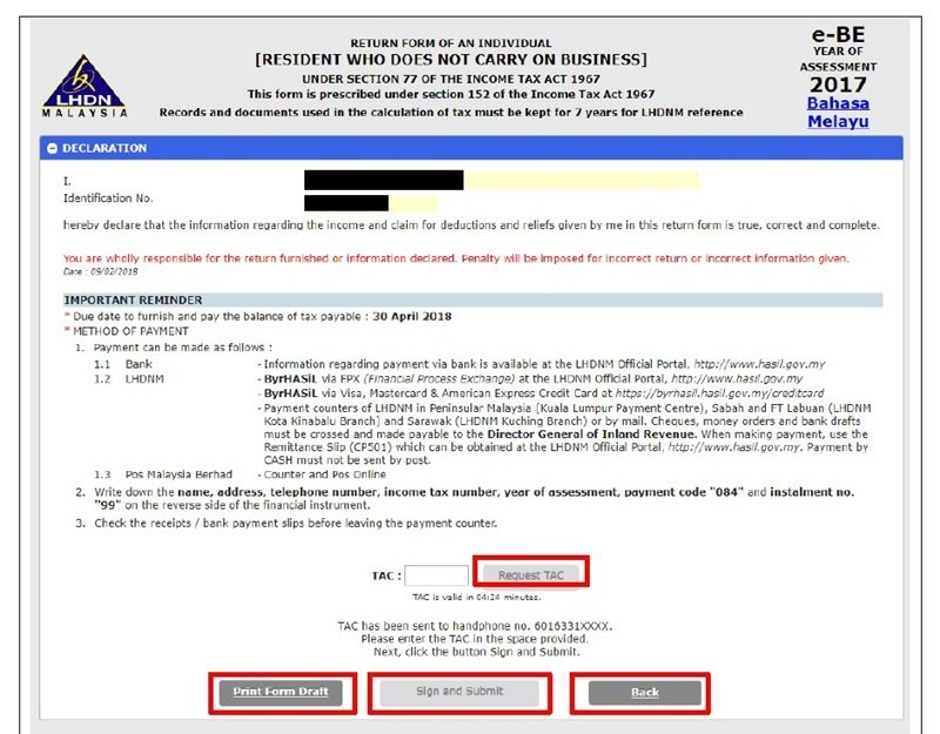

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30. 13 rows 30. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022.

On the First 5000. Visit your nearest IRB branch if you need help to complete your income tax return form or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas. Malaysia Personal Income Tax Guide.

1 Individual and dependent relatives. They need to apply for registration of a tax file.

Due Day Extended For Personal Tax Submission 15 May 2013 E Filing

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Personal Income Tax Archives Tech Arp

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

10 Highlights For Malaysia Income Tax Filing Youtube

9 Income Tax Ideas Income Tax Income Tax

Income Tax Submission Yy Chong Co

Deadline For Some Income Tax Returns Remains Irb

7 Tips To File Malaysian Income Tax For Beginners

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Malaysia Personal Income Tax Guide 2020 Ya 2019

A Malaysian S Last Minute Guide To Filing Your Taxes

Income Tax Everything They Should Have Taught Us In School The Full Frontal

Malaysia Personal Income Tax Guide 2020 Ya 2019

State Corporate Income Tax Return Deadline Changes Wolters Kluwer

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Malaysia Personal Income Tax Guide 2020 Ya 2019

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Comments

Post a Comment